Advent Calender 2018

Changes in prospectus law: leaner, lighter, and more flexible language

The third stage of the amendment of securities prospectus law on the basis of the EU Prospectus Directive will take effect on July 21, 2019. While the first two stages govern exceptions to the obligation to publish a prospectus, the new provisions stipulate key changes to the contents of securities prospectuses.

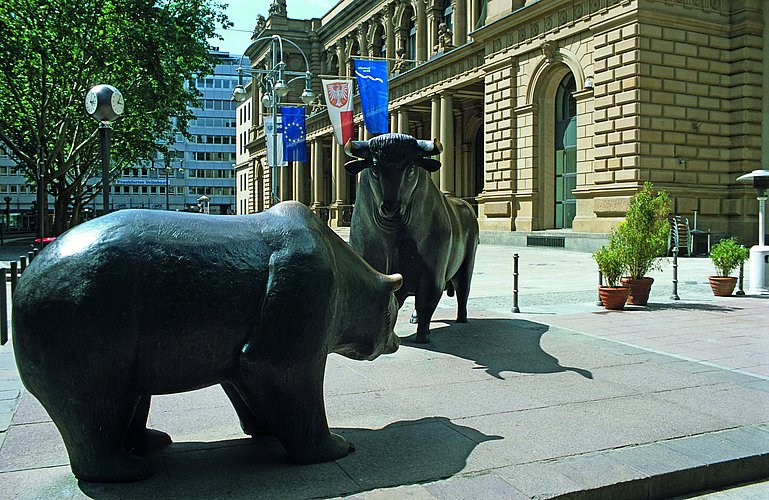

The EU Prospectus Directive governs the obligation to publish a prospectus and the content that is required for public offerings of securities or their admission to trading on a regulated market. In principle, the addressees are all those companies that intend to have securities traded on the regulated market of a stock exchange and/or to issue securities by way of public offering.

In addition to amendments of the scope of application or exceptions to the prospectus requirement, the EU Prospectus Directive also entails changes in the content of future securities prospectuses. The language regime will be made more flexible so that it will be possible to draw up prospectuses in English even for matters relating to Germany only. If a prospectus is used exclusively for the admission of shares to the Regulated Market, it can always be drafted in English. For prospectuses that (also) form the basis of a purely German public offering, approval by BaFin will also be required in the future, thus lowering the requirements in this respect.

In addition, the EU Prospectus Directive will also lead to prospectus streamlining. In the future, the mandatory summary will be limited to a maximum of seven pages. Risk warnings, which have been excessive at times, will be reduced to a maximum of 15 risk factors with respect to issuer, securities, and guarantors.

The EU growth prospectus, a lighter prospectus for certain companies, in particular small and medium-sized enterprises (SMEs), will also be introduced. It will contain abbreviated content as well as standardized presentation and order. The EU Commission is set to issue additional details on the design of the EU growth prospectus in January 2019. The EU Prospectus Directive explicitly stipulates that the EU growth prospectus must be significantly simpler than a standard prospectus so as to streamline administrative procedures and to make it cheaper.

A number of items will therefore be simpler in future prospectus law. Companies are invited to contact us for any remaining questions.

Your contacts are the experts from the Capital Markets Practice Group. Dr. Mirko Sickinger and his team specialize in capital market and prospectus law.

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/6/b/csm_Besprechung_Laptop_Haende_45d0bbe7d2.jpg)