Hurdle Shares for incentivising founders and (senior) employees of start-ups

I. Introduction

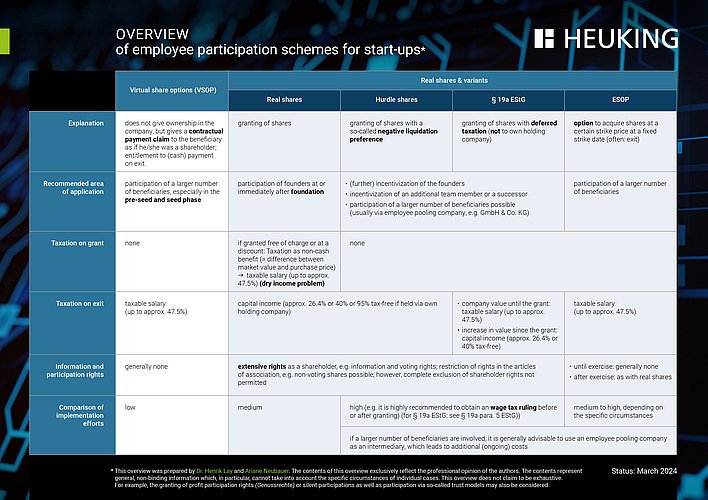

Incentivising founders and (senior) employees plays an important role, especially in start-ups. However, the classic real and virtual participation schemes do not always achieve the desired incentive effect. Under certain circumstances, the classic real participation schemes can even lead to an unintentional, immediate and tax-damaging inflow of wages that is not offset by an inflow of liquidity (dry income).

Hurdle shares (also called growth shares or zero shares) offer an attractive alternative to the classic real or virtual participation schemes, even if this means an increased need for coordination, especially with the tax authorities.

Hurdle shares are shares which are provided with a so-called negative liquidation preference (in full: negative liquidation and profit preference) in the amount of the value per share at the time of issue or transfer (less the nominal amount usually to be paid by the beneficiary).

From a tax perspective, this arrangement initially solves the dry income problem. Since the beneficiaries (only) participate in future increases in value, hurdle shares do in principle not lead to an immediate tax-relevant inflow of wages at the time of granting.

In addition, future increases in value, in particular capital gains in the event of an exit, can be realised as capital income with favourable tax treatment. Since the Hurdle Shares are „real“ participations, capital income is generated from the participation, which is subject to the so-called flat tax rate (25% plus solidarity surcharge) or (in the case of participations of at least 1%) 40% tax-free. If the participation is held via a holding company (e.g. a UG or GmbH), the returns from the participation can even be 95% tax-free under certain conditions. Compared to current (wage) income or proceeds from a virtual participation, which are fully subject to taxation at the personal tax rate (i.e. under certain circumstances up to 45% plus solidarity surcharge), the income generated from Hurdle Shares is thus taxed much more favourably.

II. Typical use cases for hurdle shares

The granting of Hurdle Shares may be considered in particular in the following constellations:

1. (Further) incentivising the founders

The issue of (further) incentivising the founders applies especially to start-ups that have been on the market for a long time and have gone through several rounds of financing. Due to the financing rounds, the founders' shareholdings are usually heavily diluted over the years, so that at a later stage in the company they only have a small stake in the share capital of their own company. In this constellation, further shares – structured as Hurdle Shares – can be issued to the founders at nominal value in order to continue to incentivise the founders.

2. Incentivising an additional team member or successor

There are constellations in which a new team member is to be included in the circle of shareholders. For example, if an employee initially hired as CTO is later to be directly involved in the start-up. In such a constellation, shares – structured as Hurdle Shares – can be issued to the CTO at nominal value.

Incentivising a successor also becomes relevant if, for example, a founder leaves the start-up. In such a constellation, shares – structured as Hurdle Shares – can be issued to the successor at nominal value. In the event that shares of the departing founder are subject to a call option, these shares can also be converted into Hurdle Shares and transferred to the successor.

3. Participation of a larger number of beneficiaries

Beyond incentivising individual founders or (senior) employees, Hurdle Shares can also be considered for the participation of a larger number of employees. In this case, however, the employees should be pooled through a pooling agreement, the interposition of a special employee shareholding company (often referred to as a pooling vehicle and usually in the form of a (tax-transparent) GmbH & Co. KG) or a trust structure, especially in order not to complicate decision-making processes at the level of the start-up due to a large number of (small) shareholders.

4. Excursus: Hurdle Shares in Succession Planning

This article is about the use of hurdle shares in start-ups. However, we would like to mention that Hurdle Shares can also be used, for example, in succession planning for companies. If, for example, Hurdle Shares are created in a family business and transferred to the next generation, the burden of inheritance or gift tax can be reduced and thus prove to be an interesting tool for succession planning.

III. Classic real and virtual Participation schemes

The participation schemes that have been widespread in the market to date, where a distinction can be made in principle between classic real participation schemes and virtual participation schemes, entail various consequences in the constellations described above, in particular tax consequences, which often make the implementation of these schemes appear less attractive.

1. Classic real participation schemes

If founders or employees (hereinafter referred to as the beneficiaries) are granted real participations, they become shareholders of the start-up with all associated rights (e.g. participation, voting and information rights) and obligations (e.g. fiduciary duties). In particular, the beneficiaries – like all other shareholders – participate in any profit distributions and exit proceeds.

The granting of a real participation in a start-up basically requires the creation of new shares by increasing the share capital or the transfer of existing shares from a shareholder to the beneficiary. Both a capital increase resolution and a share purchase and transfer agreement require notarisation (with the corresponding cost consequences) to be effective.

From a tax point of view, the decisive factor in this context is the share price for which the shares are granted to the beneficiary. If these are transferred or taken over at a share price below the actual value (the market value) of the shares, the difference between the actual value and the share price to be paid leads to a so-called non-cash benefit for the beneficiary, which is taxable as part of the salary at the time of receipt.

In the case of the granting of a real participation, such an inflow already exists when the beneficiaries have taken over the shares in a legally effective manner or when they have been transferred to them. At this point, however, the beneficiaries have "only" received the shares, but no liquid funds to pay the resulting tax. This is also referred to as so-called dry income, i.e. income leading to tax which is not matched by an inflow of liquid funds (= dry). This often represents a considerable burden for the beneficiaries, as they have to pay the tax from other own assets.

In order to counteract this, the legislator introduced a regulation in July 2021 with § 19a EStG, by which the taxation is to be postponed. This means that the tax is not already due when the shares are transferred or taken over, but only when the beneficiaries further transfer their shareholding or the company is dissolved. The idea is that the tax is only levied when the beneficiaries have actually received liquid assets. In practice, however, this regulation has unfortunately proven to be unsuitable due to its concrete design.

Already the rather narrow scope of application of § 19a EStG proves to be an obstacle. The deferred taxation only applies if the company fulfils the so-called SME criteria of the EU, i.e.

- has less than 250 employees and

- has an annual turnover of no more than EUR 50 million or a balance sheet total of no more than EUR 43 million and

- no more than 12 years have passed since the foundation.

This means that in particular scale-ups fall through the cracks if one of the aforementioned size criteria is exceeded.

The so-called realisation events also prove to be a greater obstacle. These events trigger taxation irrespective of a resale or dissolution of the company if more than 12 years have passed since the transfer or takeover of the shares or if the service or employment relationship ends. In particular latter is to blame for the fact that § 19a EStG does not play a role in practice. The realisation events result in the sword of Damocles of taxation hanging over the beneficiary. For example, if the beneficiary changes the employer, the tax is levied - retrospectively - even if no liquid funds accrue to the beneficiary at that time. The dry income problem is thus merely postponed to the future.

For clarification, the following (simplified) example: The beneficiary is granted 100 shares in the start-up at nominal value (i.e. EUR 1.00 per share). At the time of the grant, the start-up with a share capital of EUR 27,500.00 had a pre-money valuation of EUR 15 million. The beneficiary would have had to pay EUR 545.45 per share, so he received EUR 544.45 per share and thus a non-cash benefit totalling EUR 54,445.00 as wages. At a tax rate of 42% (plus solidarity surcharge), this leads to a tax burden of EUR 24,124.58 that can be deferred in accordance with § 19a EStG. If the beneficiary leaves the start-up before an exit or if no exit takes place within 12 years, the tax is levied without the beneficiary having received liquid funds; the beneficiary must therefore raise the EUR 24,124.58 from his other assets.

This means that one of the main objectives of the introduction of § 19a of the Income Tax Act - to provide a solution to the problem of dry income and to remove this obstacle to the granting of a real participation - was missed. It is true that the tax allowance for the granting of employee shares to employees at a discount or free of charge has been increased from EUR 360 to EUR 1,440 per year since the 2021 assessment period, i.e. it has been quadrupled. However, the allowance only applies if the employee participation programme is open to all employees who have been with the company for more than one year. This regulation therefore does not help in a large number of cases in which certain employees are to be granted a real shareholding in a start-up (apart from the fact that the allowance is still far too low to reflect such a shareholding in a meaningful way).

2. Virtual participation schemes

Currently, the most common form of employee participation – partly due to the shortcomings of granting real participations described above – is virtual participation schemes. When granting a virtual participation, the instruments are mostly referred to as virtual shares or virtual options (hereinafter referred to as virtual options) which convey a purely legal claim of the beneficiary against the start-up.

Due to the granting of a virtual option, the beneficiaries in the event of an exit of the start-up (i.e. a majority share or asset deal or IPO) are economically placed as if they were real shareholders of the start-up. As a rule, the holder of the virtual option is placed on an equal footing with the holder of shares without special preferential rights (so-called common shares), which are usually at the lowest level in the "waterfall" of the distribution of proceeds after an exit or other liquidity event.

However, virtual options generally do not grant any shareholder rights, in particular no rights to participate in or vote at shareholder meetings. In addition, the beneficiaries (until exit) generally have no right to participate in any profit distributions.

As this is a virtual participation, only the conclusion of a simple contract between the beneficiary and the company is required for the granting. There are no notarisation requirements. As a rule, participation programmes are often set up for this purpose, the conditions of which apply in principle to all beneficiaries. In practice, the allotment is then often made via separate letters to the individual beneficiaries, which in principle also allow individual conditions to be stipulated or modified separately.

In a later phase of the start-up, a so-called base price (also called strike price) above EUR 1.00 per virtual option is usually agreed. The base price is often based on the pre-money valuation of the last financing round before the virtual options are granted. However, the beneficiary does not have to pay the base price, but in the case of an exit it is mathematically deducted from the revenue share to which he or she is entitled per virtual option, because the aim of virtual participation scheme is to allow the beneficiary to participate in increases in the value of the start-up to which he or she has contributed through his or her work. In practice, there are various ways of tailoring the calculation to the needs of the start-up.

For the beneficiaries, the payment of the revenue share in the event of an exit is a kind of bonus payment that leads to fully taxable (wage) income. However, the granting of the virtual options alone - unlike in the case of the granting of a classic real participation - does not have any tax effects for the beneficiaries, in particular there is no assumption of a non-cash benefit. Dry income is therefore avoided. Taxation only occurs at the time of payout, i.e. in the case of an exit. The amount of tax to be paid upon disbursement then depends on the personal tax rate of the beneficiary, which can be up to 45% (plus solidarity surcharge). Taxation as income from capital assets is out of the question.

The tax disadvantage of the virtual participation models compared to a real participation is therefore obvious: Only in the case of a real participation does the beneficiary benefit from the privileged taxation of the proceeds generated in the case of an exit as capital income, i.e. taxation at the flat tax rate of 25% (plus solidarity surcharge) or (for participations of at least 1%) the 40% tax exemption or a 95% tax exemption if the shares are held via a separate holding company.

In summary, it can be stated that the implementation of classic real participation schmes is particularly hindered by the dry income problem. The use of the deferred taxation provided for in § 19a EStG is generally not advisable due to the so-called realisation events, according to which, in particular, taxation occurs without an inflow of liquidity even if the service or employment relationship ends. In contrast, virtual participation schemes do not lead to dry income. However, due to the lack of possibility to qualify the proceeds generated in case of an exit as income from capital assets, these schemes are significantly less attractive from a tax perspective. In the absence of the granting of shareholder rights, it should also be noted that under certain circumstances, especially for founders and senior employees, the same incentive effect cannot be achieved as with a real participation.

IV. Hurdle Shares as an alternative form of classic real participation

The problems of the classic real and virtual participation schemes can be largely avoided by using Hurdle Shares. With the right design, they first avoid the dry income issue. In addition, future increases in value can be realised as capital income with favourable tax treatment. Finally, Hurdle Shares offer the opportunity to contribute to incentivisation by granting shareholder rights.

As described above, Hurdle Shares are characterised by the fact that they are provided with the so-called negative liquidation preference. This means that the shares in question are excluded from participating in the existing value of the company; they participate (proportionately) only in the future increase in the value of the start-up.

A (simplified) example: In the context of a Series B financing round, which is based on a calculated share price of EUR 500.00 for the Series B Preferred Shares, Hurdle Shares are issued as an additional share class to a founder at a nominal amount of EUR 1.00 each. These Hurdle Shares will only participate in the distribution of corresponding exit proceeds if the calculated share price attributable to the respective Hurdle Share in the course of the exit exceeds the amount of EUR 499.00 and then only in the amount of the share exceeding the amount of EUR 499.00. If the calculated share price attributable to a Common Share in the course of the exit amounts to EUR 1,000.00, EUR 501.00 shall be attributable to a Hurdle Share.

Accordingly, the Hurdle Shares only participate in the increase in the value of the company that takes place after their issue. Since there is no participation in the already existing value of the company, there is no shift in value to the beneficiaries at the time of granting, i.e. there is no inflow of a non-cash benefit relevant for income tax purposes (= no dry income).

Since the Hurdle Shares are real shares, the appreciation in value (i.e. the EUR 501.00 attributable to the Hurdle Share in the example) can also be collected as capital income with favourable tax treatment in the event of a subsequent sale.

However, it is important for the tax acceptance of the Hurdle Shares that the valuation on which the issue of the Hurdle Shares is based, i.e. the determination of the "hurdle", can be documented in an appropriate manner.

V. Timing of the creation of Hurdle Shares

Especially if (as usual) no valuation report is obtained, the time of creation and granting of Hurdle Shares as well as the valuation of the start-up documented at that time is thus of essential importance.

In this respect, the proximity to a financing round can provide a good starting point for determining the amount of the hurdle. After all, the share price on which a financing round is based is negotiated among independent third parties. In practice, therefore, Hurdle Shares are usually created in the context of a financing round in order to reduce valuation risks. Secondary transactions can also be used as a benchmark under certain circumstances.

VI. Wage tax call information and/or binding information

From a tax point of view, however, it is generally advisable to secure the concept of the Hurdle Shares with a wage tax ruling at the level of the company. Upon issuance of the wage tax ruling (Lohnsteueranrufungsauskunft), the competent tax office checks whether the issue of the Hurdle Shares leads to the granting of a non-cash benefit. The valuation of the start-up described above and the burdening of the Hurdle Shares with the negative liquidation preference are of decisive importance here.

In terms of time, it must be taken into account in this respect that the issuing of a wage tax ruling may well take several months and the participation may also not yet be implemented during this time.

In addition, it must be taken into account that the wage tax ruling only has a binding effect for the company. For further tax certainty, a binding tax ruling (verbindliche Auskunft) can (additionally or alternatively) be obtained at the level of the beneficiaries. It should be noted, however, that a binding tax ruling - unlike a wage tax ruling - is subject to a fee and can often take more time than a wage tax ruling. This applies in particular if shares are to be issued to several beneficiaries and, in addition to the tax office responsible for the company, various tax offices of the individual beneficiaries' domiciles are to be involved. Which way is the right one here must therefore be assessed in each individual case.

VII. Company law Implementation

If an agreement is reached with the tax authorities, the Hurdle Shares should only be granted after receipt of the positive wage tax ruling or binding tax ruling. If the Hurdle Shares are issued in the course of a financing round, this does not mean though that the financing round cannot be carried out until that time. For example, a so-called authorised capital can be created for the Hurdle Shares, which authorises the management to issue the shares as soon as the positive tax ruling has been issued. The financing round can then initially be carried out without issuing the Hurdle Shares.

Hurdle Shares can in principle have the same rights and obligations, in particular the same voting rights, as Common Shares, which can have an additional incentive effect. Hurdle Shares are then a subclass of Common Shares, so to speak. Hurdle Shares can also be structured as a separate share class, e.g. as non-voting shares. This would have to be anchored in the articles of association accordingly, whereby any tax valuation consequences must always be kept in mind in the concrete structuring of the shares.

The main difference to Common Shares is that the Hurdle Shares only benefit from an exit above the respective hurdle. This hurdle can of course be reduced over time if there are distributions in which the Hurdle Shares do not participate due to the negative liquidation preference on them. Typically, the negative liquidation preference is reflected in the shareholders' agreement.

Almost all participation models have in common that they contain so-called vesting rules. Vesting rules serve to bind the beneficiaries to the start-up and to incentivise their commitment and loyalty to the company by providing for the partial or complete forfeiture of shares in the event that a beneficiary has not worked for the start-up for a certain minimum period of time or has committed a serious breach of duty, for example. Hurdle Shares can also be subject to vesting. Corresponding regulations are also typically anchored in the shareholder agreement.

The shareholders' agreement should also stipulate who is entitled to the (arithmetical) proceeds attributable to the Hurdle Shares up to the amount of the hurdle. As a rule, these are all other shareholders, i.e. those shareholders who were already shareholders in the financing round that was the basis for the valuation of the hurdle or who became shareholders in connection with the financing round. The proceeds (arithmetically) allocated to the Hurdle Shares in the waterfall are then distributed to the other shareholders up to the amount of the hurdle then applicable.

However, the situation can be more complex in subsequent financing rounds. Here, care must be taken to ensure that the economic burden of the Hurdle Shares is consistently reflected in the course of determining the share price on the one hand and the allocation of the proceeds up to the amount of the hurdle on the other. Typically, the share price is calculated by dividing the pre-money valuation of the start-up by the number of shares issued (and, if applicable, the number of virtual options). If the Hurdle Shares are taken into account in the calculation as full shares, the share price to be paid by the investor is reduced accordingly. Since in this case the proceeds (arithmetically) attributable to the Hurdle Shares were taken into account in the share valuation, the investor may not benefit from them even in the event of a later exit, i.e. the proceeds (arithmetically) attributable to the Hurdle Shares up to the amount of the hurdle are to be allocated solely to the existing shareholders in the waterfall. This is also consistent because they accepted a lower share price when the investor entered and were diluted accordingly.

VIII. Conclusion and outlook

Hurdle Shares offer a very good opportunity to give founders and (senior) employees a stake in start-ups. The disadvantages of the classic real participation schemes as well as virtual participations can be avoided.

However, participation through Hurdle Shares is generally only considered in connection with a financing round or another valuation of the company by a third party. An adjustment of the tax and legal environment is therefore still desirable. As the press currently reports with reference to an internal paper of the Federal Ministry of Finance, a remedy might be found soon.

After relief was announced last summer, there are now apparently plans that go beyond the further increase of the tax allowance from EUR 1,440 to EUR 5,000 already announced at that time. While this increase was criticised as insufficient, according to reports, the dry income problem shall now to be dealt with. Taxes on employee shareholdings shall become due only after 20 years (and not after 12 years, as is currently the case). In addition, the new rules shall apply to a much larger number of start-ups by doubling the current caps. Then the regulation would also apply to companies with up to 500 employees (instead of 250), sales of up to EUR 100 million (instead of EUR 50 million) and an annual balance sheet total of EUR 86 million (instead of EUR 43 million), so that scale-ups would no longer be blocked from using this rule.

There is also hope that other approaches to simplify employee share ownership are being discussed, such as the application of a reduced tax rate on virtual share ownership instead of wage taxation. However, it remains to be seen whether the "big hit" will be achieved.

![[Translate to English:]](/fileadmin/_processed_/3/3/csm_Lay__Dr._Henrik_print_ca7eabe0f2.jpg)