Future Financing Act: Tax framework improvements for employee participation resolved

The Future Financing Act was enacted by the Bundestag on November 17, 2023, and ratified by the Federal Council on November 24, 2023. In the near future, the law should be published in the Federal Law Gazette, leading to an improvement in the tax framework for employee profit participation as a result of the new Section 19a German Income Tax Act provisions taking effect on January 1, 2024.

While some in the startup community hail the new regulations as a revolution, others remain wary. The tax system for employee stock options has in fact been strengthened: In many circumstances, the dry income problem can now be avoided, and employees may benefit from more favorable taxation as capital income in the event of a subsequent sale of shares (exit). The framework conditions under corporate law, on the other hand, remain unchanged.

Changes from the government bill

The version of Section 19a Income Tax Act adopted by the Bundestag essentially contains the provisions already included in the government bill, on which we reported in our August 24, 2023 article. In comparison to the government bill, the following changes were made:

- Adjustment of “realization events” - extension of the relevant period to 15 years rather than 20 years:

The “realization events,” which result in deferred taxation irrespective of resales where a period exceeding twelve years has elapsed since the acquisition of shares or the termination of a service or employment relationship, are the most significant impediment to the application of Section 19a Income Tax Act in its current form. These realization events have thus far rendered the provision outlined in Section 19a Income Tax Act inconsequential in practical application. The relevant period will, however, not be extended to 20 years – as still envisaged in the government bill – but only to 15 years (i.e., an extension by three years instead of eight).

- Expansion of participation forms – removal of group clause:

Another barrier to using Section 19a Income Tax Act in its current form is that participation is frequently granted in a company other than the one with which the employment relationship exists, such as the parent company of a group of enterprises. In many instances, the participation is also to be granted by a shareholder of the employer. While both of these cases were still included in the government bill, only the circumstance where the participation is granted by a shareholder in the employer is now included in the law. The Finance Committee, on the other hand, removed the “group clause” without replacement, implying that the scope of applicability of Section 19a Income Tax Act will no longer apply to the granting of participations in enterprises other than the employer in the future.

- Insertion of a “fictitious inflow of funds”:

Following the Finance Committee’s recommendation, Section 19a(1) Income Tax Act was amended to read: “In such event, a benefit within the meaning of sentence 1 shall also be deemed to have accrued where it is legally impossible for the employee to dispose of the shareholding.” As a result, shares with restricted transferability that are subject to restrictions on disposal in the articles of association are deemed to have accrued at the time the shares are granted to technically enable tax deferral under Section 19a Income Tax Act. This provision can only be considered a clarification, though. In compliance with general tax standards, the time of the transfer of beneficial ownership, which is obviously the case when shares with restricted transferability are transferred, must coincide with the time of the relevant inflow of funds for income tax purposes. According to the Finance Committee’s report (printed matter 20/9363), the Committee expects that, in the case of shares with restricted transferability, “a taxable inflow of income does not occur until the time of the company’s approval of the transfer, in accordance with established case law and also in the opinion of the administrative agencies.” This presumption, however, is wrong. Because of the (incorrect) explanatory memorandum to the law, it is now feared that this will be implemented by individual revenue offices, causing significant uncertainty in the case of employee and management shareholdings outside of the new Section 19a Income Tax Act.

Area of application & use

From January 1, 2024 on, the amended Section 19a Income Tax Act will allow the following employee profit participation schemes to be used:

Employees may be granted (genuine) shares free of charge or at a reduced price by the employer or an employer shareholder under Section 19a Income Tax Act (i.e., either the employee may acquire new shares as part of a capital increase or the employer or an employer shareholder may transfer existing (own) shares to the employee) without triggering dry income taxation.

Section 19a Income Tax Act also applies in cases where the shares are granted indirectly through a partnership rather than directly to the employee. Indirect granting through a corporation, however, such as an entrepreneurial company (with limited liability) held by the employee, is not covered. As a result, the Section 19a Income Tax Act benefit cannot be paired with the widespread holding model.

Section 19a(1) Income Tax Act can now be applied only if the employer did not exceed the following thresholds at the time the shares were granted or in one of the six preceding calendar years:

- 1,000 persons employed,

- EUR 100 million in annual sales, and

- EUR 86 million annual balance sheet total.

Furthermore, the employer must not have been established more than 20 years ago.

If the employer meets these criteria, there is still an inflow for income tax purposes given when the shares are granted to the employee (cf. above). According to Section 19a(1) Income Tax Act, however, this does not result in taxation in the calendar year of the transfer. Instead, taxation is deferred, although this does not apply to social security contributions. The Federal Council’s proposal to add an equivalent provision for social security contributions was not included in the legislation.

Pursuant to Section 19a(4) Income Tax Act, untaxed wages are only subject to taxation if

- the shares granted are transferred in whole or in part for a consideration or free of charge,

- 15 years have passed since the shares were granted, or

- the service or employment relationship with the previous employer has been terminated.

In cases where more than 15 years have passed or the service or employment relationship has been terminated, no taxation will occur, however, if the employer irrevocably declares, at the latest at the time of filing the income tax return following the relevant event (expiry of 15 years after granting or termination of the service or employment relationship), that it will be liable for the relevant income tax if the shares granted are transferred (Section 19a(4a) Income Tax Act). This will solve the problem of dry income taxation in many circumstances in the future. Even if statutory or contractual rights of recourse against the employee exist, however, the employer bearing the liability must (want to) economically absorb this prospective burden and then (have to) recognize it as a liability.

It also resolves the frequently occurring situation in which, upon termination of an employee’s service or employment relationship, a purchase price less than the fair market value of the shares is paid when the employer or an employer shareholder repurchases the shares granted (exercising the call option in cases of an agreed reverse vesting). In the future, the remuneration paid by the employer or an employer shareholder will replace the fair market value of the shares, which should actually govern taxation. When shares are repurchased, taxation will be dependent on the purchase price paid during the buyback. This avoids the risk of taxing unrealized values, which existed earlier particularly in leaver cases.

Following the granting of the shares, the employer must have the non-taxable benefit confirmed by the revenue office competent for the employer’s permanent establishment (Betriebsstättenfinanzamt) as part of an income tax information request. To that end, the employer must notify the revenue office competent for the permanent establishment (Betriebsstättenfinanzamt) of the value of the shares awarded to the employee at the time of granting in such a way that the non-cash benefit accruing to the employee as a result of the grant is confirmed. This is likely to result in a situation in which value reports must be submitted until another valuation is obtained (for example, through a financing round). A solution that provides the employer and the beneficiary employees with binding legal certainty in advance would have been preferable in this case.

ESOPs are sometimes referred to be the application case for the new Section 19a Income Tax Act, although this is inaccurate. The term ESOP is used in a variety of contexts. It stands for Employee Share Option Program and hence for a participation program in which employees are granted options for company shares. Section 19a Income Tax Act would apply only if the options were exercised and the shares transferred or newly created (often from authorized capital) and acquired by the employee. In particular, if the ESOP is structured in such a way that the options can only be exercised in the event of an exit, the new Section 19a Income Tax Act provides no benefit at all.

Conclusion & outlook

It remains to be seen how much the new Section 19a Income Tax Act will be used by the startup ecosystem. Despite the euphoria around the solution to the dry income issue for income tax purposes, it is critical to remember that the granting of shares may have tax ramifications for current shareholders.

The changes brought about by the Future Financing Act are positive in our opinion, but they should only be considered a first step. Given the international competition for talent, it would have been preferable, for example, if the flat-rate taxation initially contemplated in the draft bill had been retained and had not been confined to the issuing of actual shares but had also included the taxation of virtual shares.

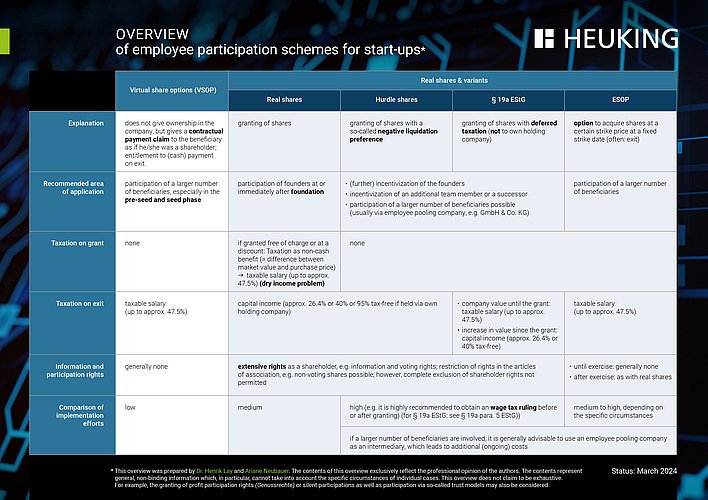

With the new Section 19a Income Tax Act regulation, a practical case of application has been introduced to the range of employee participation forms, alongside VSOPs, ESOPs, hurdle shares, etc.

![[Translate to English:]](/fileadmin/_processed_/3/3/csm_Lay__Dr._Henrik_print_ca7eabe0f2.jpg)