Potentially more favorable tax treatment of employee share ownership

Fachbeitrag

The coalition agreement had already included a provision that improving the framework conditions for employee share ownership would be tackled as a key issue for startups. In response to concerns raised by stakeholders about the efficacy of the current regulatory framework, the current draft of the Act on the Financing of Future Investments (Future Financing Act&/Zukunftsfinanzierungsgesetz) now includes a number of specific steps

What exactly is the issue?

In Germany, capital gains from the sale of shares in a corporation are taxed more favorably than regular (wage) earnings. While one’s entire wage or salary is subject to the personal tax rate, income from investments is taxed at either a “final withholding tax” of 25% (plus a solidarity surcharge of 5% where applicable) or at a flat rate of 40% (i.e., only 60% of investment income is subject to the personal tax rate). Under certain circumstances, 95% of investment returns may even be paid tax-free if shares are held via a separate holding company.

Nevertheless, it is uncommon for German employees to hold real shares of a company – a situation for which the tax system is mostly to blame. “Non-cash benefits” are taxable as part of an employee’s salary at the personal tax rate in effect at the time the benefits are received if the company transfers real shares to an employee at a price below the actual value (the market value) of the shares, or if an employee acquires them as part of a capital increase.

Where an employee is granted a true participation in a company, such income is realized immediately upon transfer of ownership. The employee would have to pay the tax from the employee’s other assets, however, as no liquid funds have yet been transferred to cover the ensuing tax (referred to as the dry income issue).

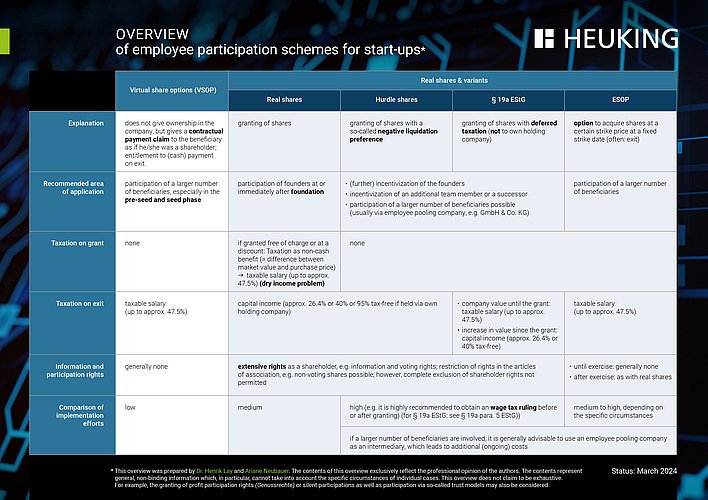

In practice, “hurdle shares” (cf. Hurdle Shares for incentivizing founders and (senior) employees of start-ups (heuking.de)) are a viable option for structuring a participation. Applying the necessary negative liquidation preference in the participation documentation adds complexity. For this reason, most employee shareholdings are based on “virtual” shares, which do not result in tax-relevant income at the time of granting but whose return flows are subject to full taxation at the employee’s personal tax rate as a salary component at the time of an exit.

The legislator recognized the problem associated with dry income and, in July 2021, established a provision in the form of Section 19a Income Tax Act, which delays the imposition of taxation on the acquisition of shares until their subsequent sale. The notion is that taxes are not payable until employees have actually received liquid funds.

In practice, however, Section 19a Income Tax Act has (so far) shown to be inapplicable due to its extremely restricted scope. The draft bill now addresses the concerns raised by the startup community in this area.

The dry income issue has a new answer

The “realization event” is the most significant barrier to the application of Section 19a Income Tax Act in its current version. Under existing law, if more than 12 years have passed since the shares were bought or the service or employment relationship ends, deferred taxation is triggered irrespective of any sale. As a result of these realities, startups, growing enterprises, and their employees frequently avoid making use of this rule for fear of incurring taxes on unrealized gains. The Future Financing Act is intended to remedy this situation.

The proposed legislation would make a 20-year window applicable. In addition, provided that the employer reports to the tax authorities to be liable for the (wage) tax to be withheld and remitted, the share grant will not be taxed until a real sale occurs. The ultimate goal of this mechanism is to protect tax claims by the government (the draft bill uses the hypothetical situation of an employee relocating to an “unknown” place abroad, in which case the German tax authorities would be unable to gain access to such employee). If this mechanism is put into place, contractual provisions between the company as employer and the employees will have to become an important component of employee participation documentation to ensure the enforcement of a recourse against a departing employee.

Alongside this new rule, the option of a 25% lump sum taxation will be offered. Employees’ non-cash benefits from a share transfer or takeover have traditionally been taxed at the employees’ marginal rate of personal income tax (generally at 42%). The draft bill’s explanatory notes state that the lump sum taxation option is meant to mitigate excessive taxation resulting from taxation based on the general wage tax scheme. Critics, including from inside the coalition government, have already voiced their opposition in the lead-up to this proposal, so it remains to be seen if this privileged treatment will survive the legislative process.

The draft bill further specifies that if shares are repurchased, the purchaser will only be taxed on the amount of the repurchase price. This reduces potential tax liability associated with unrealized gains since the purchase price is frequently below the participation’s market value, particularly in leaver cases. Buybacks by shareholders of the employer are not covered by this clause, however, since it only applies to employer buybacks (or a group company of the employer within the meaning of Section 18 Stock Corporation Act). In practice, it is generally desirable to avoid a buyback by the company and instead conduct the buyback at shareholder level. By doing so, Sections 7(7) and 8 Inheritance Tax Act (fictitious) gift tax factual disputes can be avoided. It would therefore be preferable if both buyback scenarios could be reflected in the law.

Expanding the forms of participation

Additionally, the fact that the participation is not necessary to be granted in the company with which the employment relationship exists (but, for instance, in the parent company of a group of companies) sometimes proves to be a barrier to the adoption of the existing provision of Section 19a Income Tax Act. Therefore, in the future, the provisions on deferred taxation are to apply not only if the shareholding is granted by and in the employer, but also if the shareholding is granted in other group companies (companies within the meaning of Section 18 Stock Corporation Act).

Moreover, the new rule shall also apply if the shareholding is granted by a shareholder of the employer. Therefore, in contrast to the current status, the transfer by the founders or investors themselves will also be favored in the future, which means that in certain cases, such as when a retiring founder’s shares are to be transferred to a successor, the transfer will fall in the scope of Section 19a Income Tax Act. Incidentally, the extension to the granting of the shareholding by a shareholder of the employer shows that it would be appropriate to also extend the repurchase provision described above to the shareholders.

Extension to scale-ups

Currently, only companies that met the EU’s “SME criteria” are eligible for the deferred tax regime, so that so far “scale-ups” in particular cannot make use of such regime if they surpass the necessary size threshold. The double amounts of the SME criteria are to apply in the future, meaning that companies with up to 500 employees and less than EUR 100 million in annual sales or a balance sheet total of no more than EUR 86 million will also benefit. Under the current rules, only companies with fewer than 250 workers, EUR 50 million in annual sales, or a balance sheet total of no more than EUR 43 million benefit from the provision. Additionally, as opposed to just the most recent calendar year, in the future it will be sufficient if the thresholds are not exceeded at the time of transfer or purchase or in any of the past six (!) calendar years. In addition, companies that were founded during the past two decades will also be eligible for the relief in the future. Until now, just the twelve years preceding the date of the grant of the participation have been considered. This implies that in the future a much larger number of businesses will be eligible to benefit from the deferred tax regime than in the past.

Allowance increase

Finally, there is also an increase from the present EUR 1,440 annual tax-free allowance in Section 3 no. 39 Income Tax Act to EUR 5,000. This allowance applies to an employee’s benefit from the free or reduced-price transfer of certain share participations. The tax-free amount, however, will only apply if the employee participation program is available to all employees who have been with the company for at least one year. In addition, the full benefit of the tax exemption shall not kick in until the shares have been held for at least three years to avoid windfall gains alongside the rise in the tax-free allowance.

Conclusion

The current draft bill of the Future Financing Act is an encouraging move in the right direction since it would make it possible for employees to join in the value growth of start-ups and scale-ups through “real” shares rather than just virtual participation models. There are, however, other drawbacks to consider.

It would be helpful, for instance, if the proposed lump sum taxation applied not just to the issuance of physical shares but if the issuance of virtual shares were also subject to a separate taxation regime. Finally, the issuance of a “real” shareholding gives rise to a number of consequential legal issues. It is also important to take into account the costs of implementing a “real” shareholding.

The draft legislation also fails to deal with how the companies should be valued. This is necessary to determine the value of any in-kind benefits received as part of a share transfer or purchase, which is then taxed retrospectively. Valuing a startup or growing business can be challenging since traditional approaches will not always work. Since a wage tax ruling request has no binding effect for the employee’s residence tax office in the context of the assessments, the current (and, according to the draft bill, also future) regulation under which, following the transfer or takeover of the company’s shares, the permanent establishment tax office must confirm the non-cash benefit granted by the employer by way of the wage tax ruling is likely to be deemed insufficient in many constellations. Here, a solution would be desirable that offers companies and employees legal certainty in advance and in a binding manner.

We will keep you updated on the continued progress of the draft bill.

![[Translate to English:]](/fileadmin/_processed_/3/3/csm_Lay__Dr._Henrik_print_ca7eabe0f2.jpg)