Procedure and Contractual Documentation of a Venture Capital Financing

The volume of venture capital financing ("VC Financing") has been rising steadily for years. More and more young companies with innovative business ideas are competing in the search for start-up financing. Since banks are unwilling to take on the financing risk in the early stages of company formation due to a lack of sufficient collateral and young companies are regularly unable to repay a loan including interest, start-ups are almost exclusively dependent on venture capitalists ("VC Investors"). In contrast to a bank, a VC Investor is not a creditor, but usually a co-shareholder in the start-up's equity capital and thus bears the entrepreneurial risk. Since the risk of loss often outweighs the VC Investor's chance of a return, a variety of compensation arrangements are required, which are reflected in the contractual documentation of a VC Financing.

In addition, the contractual relationships are characterized by the different interests and competences of the parties involved, which could not be more different: On the one hand, there are start-up founders, whose main focus is often more on the product than on legal issues, and on the other hand there are professional VC Investors represented by lawyers. The "how" of the investment as well as the details of the cooperation between the founding shareholders and the VC Investor as new co-shareholder are finally regulated in a comprehensive contractual documentation.

The following article deals with the regular course of a VC Financing as well as the contractual documentation usually used in this context.

Non-disclosure Agreement

An investor will only invest in a company if he is convinced of the success of the founders' business model. In order to be able to conclusively evaluate the "if" of the investment, the investor needs detailed insights into the start-up.

The founders are faced with the question of what information they should share with the potential investor, especially since the investor's participation is still completely unsure at this stage.

If founders do not provide sufficient information, they run the risk that the investor will refrain from investing due to the lack of a sufficient basis for evaluation. As the know-how of the founders is often the only real value of the young company, there are often concerns about the unrestricted disclosure of internal information. The fear of a copy of the idea is great.

In order to take this conflict of interest into account, from the founder’s perspective the conclusion of a Non-Disclosure Agreement ("NDA") may be of interest.

An NDA can stipulate that the disclosed company information must be treated as strictly confidential by the investor and serve exclusively as a basis for the investor's decision.

However, a large number of investors reject the conclusion of a NDA at this early stage of the business relationship, as the expenses and time required to review a NDA seems disproportionate from their perspective at this point in time. Founders should not be unsettled by this, as investors do not invest in ideas but in "brains". Investors know that a good idea is worth nothing without a strong team that can implement it.

The investor's interest in information at this stage is therefore primarily aimed at the economic potential of the business model: What is the unique selling point of the company? What is the growth potential? Do the founders have the necessary skills to implement their business model? All these questions can be answered regularly without disclosing all the internal information.

Term Sheet

If the investor is basically interested in participating in the start-up, the key points of the upcoming VC Financing are set out in a so-called term sheet. This is often only a declaration of intent, which – apart from confidentiality and exclusivity agreements – is usually not legally binding. Nevertheless, the conditions set out in the term sheet are usually not renegotiated in the subsequent procedure and thus represent the starting point for the following VC agreement.

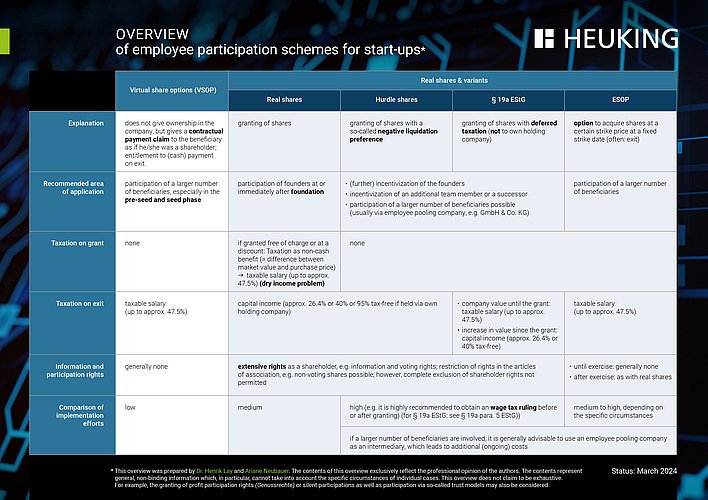

The content of the term sheet includes, among other things, the amount of the investment itself, the valuation of the company before ("pre-money valuation") and after the financing round ("post-money valuation"), employee stock option plans ("ESOPs"), co-sale rights ("tag-along") and co-sale obligations ("drag-along"), vesting rules and special rights of the investor (e.g. "anti-dilution", "liquidation preference" etc.).

Due Diligence

Before the investor participates in the start-up, he will examine the company in a so-called due diligence ("DD"). The DD includes a detailed examination of the legal, tax and economic situation of the start-up. Up-to-date and complete company documentation can significantly shorten this phase of the investment negotiations. If, on the other hand, the preparation of the most important company documents is only started after the investor has requested them, this can lead to delays and cause additional costs.

If there are still questions on the part of the investor after the conclusion of the DD or if negative findings emerge, there may still be a need for action on the part of the founders before the investment is made available.

The investor will want to protect himself against additional risks of an economic, legal or fiscal nature which cannot be eliminated by means of appropriate warranties and indemnities. If, on the other hand, there are particularly negative findings, these can lead to a lower valuation of the company or even to a failure of the investment.

In the event that essential information is withheld from the investor or false information is provided, this may justify claims for damages against the founders, who often have to be personally liable due to warranties. In an exceptional case, there is even a threat of the investment contract being reversed.

Participation Documentation

If the DD is completed satisfactorily from the investor's point of view, he enters into negotiations with the founders about the actual investment. The result of these negotiations is a variety of agreements:

1. Investment Agreement

The basis of any VC Financing is the so-called investment agreement. In addition to the regulation of the investment itself, it is often in the interest of the parties to avoid the disclosure obligation of the German Commercial Register for reasons of secrecy by making a large number of provisions already in the investment agreement and thus outside the articles of association which are published. Furthermore, with the investment agreement the parties try to overcome the existing information asymmetry. This is because, unlike the investor, the management of the start-up already has comprehensive knowledge of the company's situation. How exactly this imbalance is overcome depends largely on the various interests and cannot be answered in a generalized way. As a security, rights of control and co-determination as well as warranties and indemnities can be agreed.

2. Shareholders’ Agreement

The shareholders' agreement governs the future cooperation between existing shareholders and the investors as new co-shareholders. The shareholders' agreement, as a supplement to the articles of association, regulates the rights and obligations of the participating shareholders among themselves. In practice, the shareholders' agreement is usually directly combined with the investment agreement in a deed at the time of notarization (so-called "Investment & Shareholders' Agreement"; in short: "ISHA").

3. Articles of Association

The content or the changes to be made to the articles of association are manageable, due to the comprehensive provisions in the investment agreement, but should not be underestimated. In addition to the mandatory legal requirements, the interests of the VC Investor are decisive and therefore determine the changes to be made to the content of the articles of association to a large extent. In any case, special attention should be paid to the regulations for the exit of the investor, such as recovery and termination regulations. Further regulations, for example on the maintenance of the shareholding quota, the circle of shareholders and any information rights, are advisable, but depend on the respective interests in the individual case.

Granting of the Investment

After signing the investment documentation, the investor grants the investment sum. As a rule, the investment is structured in the form of a capital increase. In this case, the investor takes over newly issued shares in the founding company at nominal value and makes the agreed capital contribution. In addition, the investor makes an additional payment ("Premium") to the company's capital reserves. As soon as the agreed capital contribution has finally been received by the company without restrictions and reservations and the management of the company can thus dispose of the capital contribution at its discretion, the participation is complete. The start-up can now use the Premium to finance its further growth.

Conclusion

The participation of a VC Investor often creates new growth opportunities for the start-up. Due to the extensive contractual documentation and the regulations agreed upon therein with far-reaching consequences for the start-up, it is evident that the participation of a VC Investor needs to be well prepared.

![[Translate to English:]](/fileadmin/_processed_/3/5/csm_Boerger__Philipp_print_bad2ed7c39.jpg)