A cap table (capitalization table) is a central tool in the context of venture capital investments. It provides an overview of all shareholders and their percentage ownership of the startup’s share capital. The cap table shows how the shares are distributed among the various shareholders – such as founders, investors, business angels, and employees (e.g., through virtual shares) – and how the percentage ownership changes over the course of financing rounds.

A cap table is an indispensable tool for all parties involved – especially for investors and founders – to transparently and comprehensibly present the ownership structure, the effects of financing rounds, and the development of ownership interests. It forms the basis for well-founded investment decisions and the planning of further company development. A detailed cap table is not only relevant for the current financing round but also forms the basis for all future rounds. It enables the simulation of scenarios (e.g., further financing rounds, exit, employee participation) and the analysis of the effects on ownership, voting rights, and majorities.

Functions and Importance of a Cap Table

1. Transparency of Ownership Structure

The cap table provides a clear overview of who holds how many shares in the company – both before and after a financing round. This is essential for investors to understand their participation and the associated rights and obligations.

2. Importance for Voting Rights and Majorities

The ownership structure, as depicted in the cap table, is relevant not only for economic participation but also for the exercise of voting rights in the shareholders’ meeting. Usually, voting rights are based on the number of shares held. Thus, the cap table directly shows who can achieve simple or qualified majorities – a crucial aspect for the control and management of the startup. In addition to statutory majorities (simple majority, qualified majority), special majorities can be defined in the shareholders’ agreement (SHA) or articles of association (AoA), such as an “Investor Majority” or veto rights for certain shareholder groups. The cap table can be used to simulate these majorities and check which shareholders (or groups) can jointly reach certain thresholds. For example, it can show whether the lead and co-lead investors together form an investor majority or whether the founders (possibly together with business angels) jointly hold a blocking minority.

3. Calculation of Dilution

With each new financing round, new shares are issued, reducing the percentage ownership of existing shareholders (dilution), unless they also participate in the financing round with further investments. The cap table shows how the shares of individual shareholders change in the course of a financing round.

4. Planning and Negotiation of Investments

Investors use the cap table to see what percentage of the company’s shares they receive for their investment and how their participation compares to other investors and founders. The company’s valuation (pre-money and post-money) is also shown in the cap table. A properly maintained cap table is a prerequisite for future financing rounds, as it forms the basis for valuation and the allocation of new shares.

Key Pitfalls related to the Cap Table

1. Insufficient Founder Participation

A common problem for startups, especially those spun out of venture studios, universities, or corporates, is an unbalanced capital structure. In these cases, the founding organization often retains a very high share of the share capital, while the founder/management team receives only a small or no equity stake. Without sufficient equity participation, the founder/management team lacks motivation to drive the startup forward in the long term and with full commitment. Such constellations are unattractive to investors, as there is concern that the founder/management team is not sufficiently incentivized. Startups with such a cap table structure are often considered “uninvestable.” Before a financing round, the ownership structure must be adjusted in such cases to give the founders an appropriate share in the startup and make it attractive to investors. This takes time and money and should therefore be considered early on. A balanced capital structure, in which the founder/management team has a significant stake, is essential for investability and the long-term development of the startup. As a rule of thumb, the founder/management team should still hold more than 50% up to and including the Series A financing round.

2. Dead Equity – Excessive Participation of the “Wrong” Shareholders

Another problem arises when an excessively large share of the startup is held by passive or inactive shareholders (especially inactive/passive founders). In this case, we speak of dead equity. These shareholders still participate in the value appreciation of the startup but no longer contribute any added value themselves. This can be problematic for future investors. Inactive/passive founders should therefore not hold a significant share in the startup. Implementing a vesting before the first (and possibly further) financing rounds offers good protection in case a founder leaves the startup prematurely.

3. Blocking Situations

Finally, the majority of the share capital and thus the voting rights should ideally be held by those actively driving the startup forward, namely the founder/management team and active investors. Required majorities can thus be achieved quickly and efficiently. Where possible, the voting rights of smaller investors (especially business angels) should be pooled to simplify the voting process.

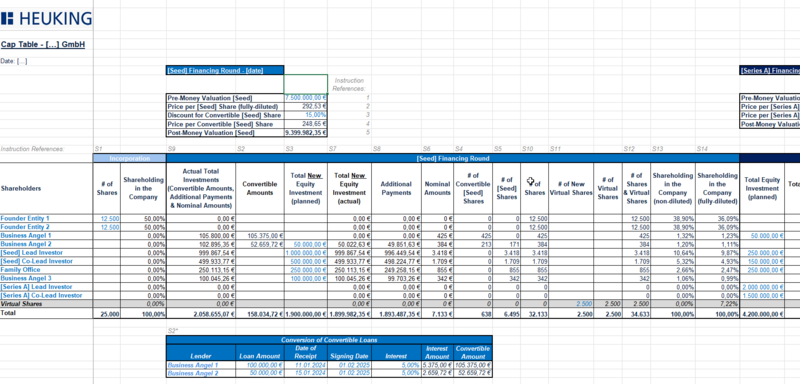

Our Sample Cap Table*

The sample cap table we have created shows, by way of example, how the shareholdings may look after a Seed and a Series A financing round. It includes:

- The founders’ shares before and after the rounds

- The investments and shares of various investors (including business angels, family office, lead/co-lead investors)

- The conversion of convertible loans into shares with a discount

- The consideration of virtual shares for employees (VSOP), with the resulting dilution borne pro rata by all shareholders

- The calculation of shares both undiluted (without virtual shares) and fully diluted (including virtual shares)

- The development of the company’s valuation (pre-money, post-money)

In the sample cap table, certain values (e.g., investment amounts) can be entered manually (these are in blue font), while others (e.g., percentage ownership) are calculated automatically. The sample cap table can therefore be adapted to any startup and the respective financing round.

* The specific circumstances of each individual case must be taken into account. No liability is assumed for the accuracy of the sample cap table.

![[Translate to English:]](/fileadmin/_processed_/0/d/csm_Boettcher__Dr._Oliver_print_0888225ff9.jpg)

![[Translate to English:]](/fileadmin/_processed_/3/3/csm_Lay__Dr._Henrik_print_ca7eabe0f2.jpg)